The Most Expensive Pieces of Art Ever Sold At Auction

When the Shakespeare-X Message sells for $150 Million it will be the most expensive work of art ever sold.

Here are the other recent contenders for the title.

This list below is out of date now though. Since then a Hirst bejewelled skull supposedly sold for $100M and a Klimt painting for $130M. Also there was a not cheap Warhol and then still another Picasso..

Who can keep up with this kind of inflation?

Not even William Shakespeare.

There's a better art price list somewhere else on LeeVidor.com if it interests you.

An Article from CNN Money Money Money

A bronze sculpture by Alberto Giacometti was auctioned for a record $104.3 million this week. Here are the 5 most expensive works of art ever sold on the block according to CNN Money.

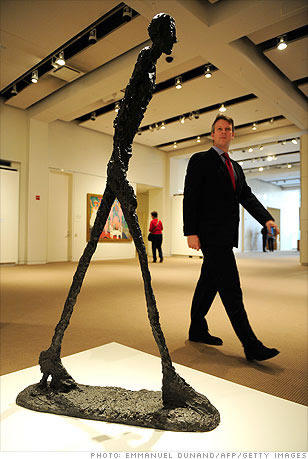

Giacometti - L'Homme qui marche I

Alberto Giacometti's life-size bronze statute set a new world's record when it fetched $104.3 million at an auction in London this week. Sotheby's said the iconic statute was bought by an anonymous bidder who paid nearly three times the expected price after a round of intense bidding.

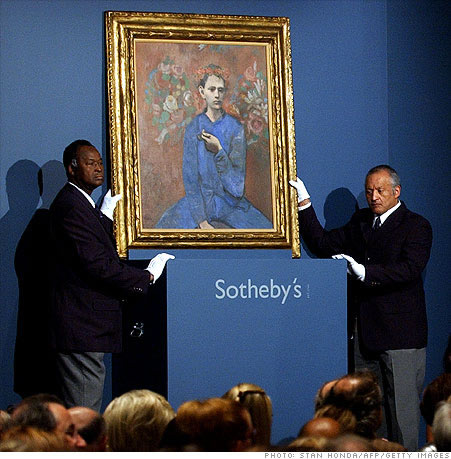

Picasso - Garçon à la Pipe

Pablo Picasso's painting of a Parisian boy smoking a pipe was bought by an anonymous bidder in 1994 for $104.1 million at an auction in New York. At the time, it was the highest price ever paid for a work of art at auction and far exceeded the expected price of $70 million.

Picasso - Dora Maar au chat

Picasso also holds the slot for the third highest auction price ever. This portrait of the Spanish painter's lover, painted in 1941, sold for $95.2 million in 2006 at an auction in New York.

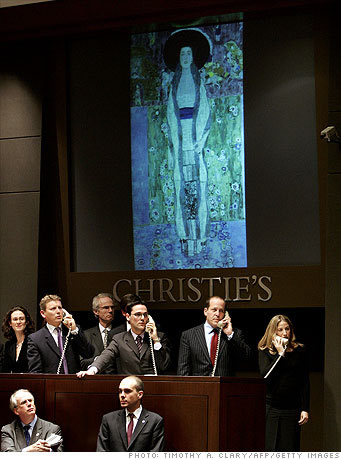

Klimt - Portrait of Adele Bloch-Bauer II

In 2006, this portrait by Austrian artist Gustav Klimt went for $87.9 million at an auction in New York. The 1912 painting is one of several portraits Klimt made of Adele Bloch-Bauer, the wife of a wealthy industrialist who sponsored the artist.

Francis Bacon - Triptych

This three panel painting by Francis Bacon fetched $86.3 million at an auction in 2008. Sotheby's had estimated it would sell for $70 million.

A Different Perspective

The Guardian, London, October 2008

by Sarah Thornton

'If the work is free, is it art?

In the past few years an unprecedented amount of money has poured into the art world. Has it become too commercialised? As Frieze, the UK's biggest art fair, opens in London, Sarah Thornton talks to eight leading artists about how the market influences them

Last Sunday night at the Old Vic theatre in London, the heavy hitters of the art world went to watch Drama Queens, a play by the artists Elmgreen and Dragset, in which five sculptures come to life and have an art-historical battle of egos. Tate director Nicholas Serota was there, as were Tracey Emin, Peter Doig and New York power critics Jerry Saltz and Roberta Smith. On stage, Barbara Hepworth's Elegy III flirted with Sol Lewitt's Four Cubes, while Giacometti's Walking Man glided about making existential comments.

But the self-appointed star of the show was Jeff Koons' Rabbit, whose voice was delivered live from the balcony by Kevin Spacey. As the bunny zoomed out from the wings, he squealed, "Hey, hey! Look, look, a rabbit!" After several manic laps of the stage, he began to tire. "So much stress," he complained. "I need to see my banker, my gallerist, my investment manager and my art editor. I need to see my AA sponsor. And I need to see my agent. There's some sponsorship thing we're trying to figure out. They want to fill me with helium and float me over Beijing."

After nearly a decade of art-market expansion, this image of a shiny happy bunny full of hot air, soaring over a newly capitalist city centre, could hardly be more apt. When I started researching a book about the art world five years ago, it was a quieter, less crowded place. You could walk into swishy evening auctions without tickets. You could find a Venetian hotel room at the last minute for the opening days of the Biennale. You could buy art by a young artist from an east London dealer for less than £2,000. But over the past five years, people and money from around the globe have poured into the art world, making it spin faster and more lavishly. By 2006, dealers and auction specialists were talking with wide-eyed disbelief about the art world's remarkable "liquidity". Where all this money came from, nobody really knew. Given the current economic crisis, is it about to dry up? As Frieze art fair opens for business in London's Regent's Park, and with major auctions scheduled for tomorrow and Sunday, we shall soon see.

What doesn't get much talked about is the effect all this money has on artists, and on art itself. Has contemporary art become decadent and status-fixated? In a recent Channel 4 documentary, art critic Robert Hughes declared that "the cultural function of a high price is to strike you blind", and singled out Damien Hirst's work as the apotheosis of this phenomenon. But does everyone want to do a Damien? Most artists refuse to give interviews about the art market, either because they have been warned off by their dealers, or because they are worried about saying something that might disrupt their sales. Perhaps talk of the markets brings back bad memories of failing maths exams (a lot of artists are bad at arithmetic).

There remains a strong feeling in the art world that good art is made by people with more profound goals or intellectual ambitions than simply making money. As the former YBA Gavin Turk told me: "If artists are primarily motivated by profit, they may not be artists any more. They could just be producers of something." Turk, 41, started out at the heart of the British art scene, one of the many YBAs represented by Jay Jopling's White Cube gallery. These days, he's a sculptor and prankster. When I meet him at his studio in east London, he is even wearing a black beret. His art often interrogates the art world's love of easily identifiable brands, perhaps in itself not a very commercial move. Turk left White Cube some years ago because, he says, his "thoughts and schemes didn't really have a place within their wow machine". He elaborates: "White Cube is good at what it does, but I wasn't competing well in that environment."

Instead he has found himself reacting against the "wow machine". One of the visual impacts of the boom on art itself has been giganticism, or enlargement - a peculiarly masculine trope. (Look at Koons' 1.75 tonne magenta Hanging Heart, and Hirst's 40ft-long spot paintings.) Hilariously, Turk's reaction has been to make smaller and smaller pieces, culminating in a bronze cast of a spent match called, quite simply, Spent Match. This comes in an edition of "approximately 38", just like a real box of matches.

This year Turk has also contributed to the "Free Art Fair", which coincides with the ticket-only Frieze and, provocatively, is sited nearby. Called Fruit Sticker, his work consists of sticky labels bearing his name, which are stuck on people as they enter the fair, transforming them simultaneously into fruit and art. The alternative fair challenges its audience to think about whether the work it hosts is as good as the art at Frieze. "Money is a necessary constituent of art," explains Turk. "If a piece has no price, is it good value? If the work is free, is it art?"

The medium that typifies the current bull market for art is painting. It hangs efficiently on the wall; it doesn't consume floor space; it is easy to store. Sensual canvases in happy colours, using glitzy materials or fetishistic techniques are a good bet. Where does this leave the many contemporary artists who don't paint - who work in mixed media, or with other artists, or with materials that decay?

Anya Gallaccio, 45, who was shortlisted for the Turner Prize in 2003, has spent a large part of her life working with ephemeral substances - salt, ice, flowers - that make her art resistant to easy trade. She has recently added more durable materials - bronze, for example - to her repertoire. Although she maintains that "you can sell anything", she sees "boom art" as essentially conservative. "In many instances, it is condoning conventional modes of representation," she says. "To be an investment, it has to be recognisable as art."

While she has a feel for the market, Gallaccio has no enthusiasm for it. This year she is many time zones away from Frieze, at the University of California, San Diego, where she has taken a position as a professor and enjoys a two-day teaching week, a huge studio and "incredible freedom". Back in 1988, when she was a student at Goldsmiths in London, Gallaccio shared a studio with Hirst, but now it is hard to imagine two more divergent career paths. "Part of the reason I took the job in California was to sidestep the commercial art world which pervades London," she says. "It was impacting on me in a negative way. Thinking time - lots of it - should be essential to an artist's practice. With so many fairs and so many demands, I felt like I was on a conveyor belt."

According to Gallaccio, the media aren't interested in art as much as "auction houses and a handful of male artists". She argues that this sort of coverage "agitates people's hostility to art as a frivolous, irresponsible activity"; it also has a detrimental effect on students' aspirations, and on the morale of the thousands of artists who work all week in day jobs so that they can spend weekends in the studio. "Even successful artists spend a lot of time in the shadows," says Gallaccio.

Different artistic media have very different cash flows. Isaac Julien's work - large-scale video installations - often cost "several hundred thousand [pounds]" to make, and require advance fundraising. But Julien says he doesn't think much about profit. "If I worried about proceeds," he says, "I might not make anything." Nor, he points out, is video art something that frequently trades at auction. "Other than the odd Bill Viola work, video is not a commodity. It's difficult to decorate with, so I'm not a hot property among speculators." Instead, he relies on serious collectors, the sort of people who have their own museums and foundations; he counts many of these collectors as friends. They are investing in "an intellectual and emotional experience", he explains - and, possibly, "a part of the artist".

Given his nonchalance about profit, what does Julien think about Hirst's £111m sale at Sotheby's last month? He is surprisingly uncynical: "Any artist who doesn't secretly admire what Damien's been able to achieve is not being entirely honest. But that level of commodification is quite specific to Damien." About the individual Hirst works that went on the block, Julien is more circumspect. "Warhol's use of repetition had real intellectual meaning. Nowadays, I wonder if seriality is not just a way of printing money."

Jeremy Deller, 42, won the Turner Prize in 2004. His most famous work is The Battle of Orgreave, 2001 - a performance that re-enacted a violent confrontation during the 1984 miners' strike, which he made into a film and then an installation. Originally commissioned by Artangel, it is now owned by the Tate. Deller tends to work with public institutions and takes no great pleasure in selling his work. "It's not a punch-the-air moment," he tells me. A collaborative artist, he prefers to collect: not expensive art, but "old posters, photography and vernacular art" from Portobello market. "It's a basic need," he explains, "surrounding yourself with stuff that you want to see."

Like the rest of the western world at the moment, Deller has little time for speculators: "Their investment life of risks and gambles makes the world more dangerous for everyone." Even so, he confesses to consuming auction catalogues the way other people might scan Hello! or Heat. "It's a guilty pleasure. You scorn the copy, but you're attracted to the pictures."

Generational differences seem to affect the degree to which artists feel commercial pressure. American-born, London-based artist Susan Hiller, 68, who comes from a 70s conceptual tradition, is part of an artist community for whom "money is not the only form of approval". Certainly, "nobody is judging past work by what it sold for initially," she says. For years, she would attend friends' shows and never think to ask if the work was sold or, God forbid, what it sold for.

Gender would appear to be a factor, too. When Hiller first exhibited her 1977 work, Ten Months, a photographic installation about pregnancy, she was told that it would ruin her career. "And it did!" laughs Hiller. (Representations of expectant women didn't prove as popular as the real thing.) Price disparities between male and female artists are glaring at all levels. At the top end, there are more living Chinese artists (all male) who make more than $1m at auction than there are living women artists making the same money in the world. (As it happens, British women are in the lead here: painters Bridget Riley, Jenny Saville and Cecily Brown have all fetched this amount.) At the bottom end, walk into any degree show and you will invariably find that the boys have pitched their asking prices higher than the girls. Still, Hiller remembers a time when women were even less supported. "No one visited Louise Bourgeois's studio until she was in her 60s," she says.

Private collectors are now a fixed point in the cultural landscape, and in artists' support systems. Young artists such as sculptor Francis Upritchard, 32, who will be representing New Zealand at the Venice Biennale next June, appreciates serious collectors who live with their art. Of collectors who keep their art in storage, she argues: "I'm sure it's good to get the work out of the sun, but art needs to be used. It needs a thinking gaze. That is what makes it art, rather than just stuff." Of collectors who acquire work as status symbols, she says: "I think they are wasting their money, because that is not what art is for. It's a misinterpretation of its intent."

Even artists who work in the time-honoured tradition of painting are wary of being sucked into market-led thinking. Landscape painter George Shaw likes to keep his work on a relatively intimate scale and refuses to rev up his output by hiring a team of assistants. "Just because you use the toilet doesn't mean that you have to live in the sewer," he says. Shaw lives and works in Devon, one of many painters (both Doig and Chris Ofili now live in Trinidad) who has left London to avoid the white noise of the market.

At 29, artist Idris Khan has experienced nothing but the boom times. His work - layered photographic images - has sold steadily ever since he graduated from the Royal College of Art in 2004. "The feeding frenzy has been weird," he says. "It is difficult to take money as an artist. That's why we need galleries - a good gallery allows you to have a free mind." He can't explain his own success, except to cite "thoughtful dealers" and to suggest that his name may attract a broader market of Middle Eastern and Indian collectors. He has seen several of his works appear at auction, and it hasn't always been a happy experience. "Struggling to hear... after Ludwig van Beethoven sonatas" was bought by a collector for £10,000 in 2006, who then sold it for £23,900 a year later. "You don't want your art to be treated like a commodity," says Khan. "I don't understand that throwaway attitude."

What will happen if the art market follows the financial markets in a downward spin? Is the bubble about to burst? Upritchard, for one, is not worried. "I lived in a squat for six years," she says. "If I had to downgrade my studio, it wouldn't matter. I want to be an old lady making art. Perhaps I'll be out of fashion at 50, but trendy at 80".

Some Statistics: (now out of date)

2007's five most expensive living artists in the world (based on total sales revenue)

£3,046,252 |

.

2007's five bestselling living women artists in the world

£959,498 |

.

2007's five most expensive dead artists

| Top auction |

||||

|---|---|---|---|---|

£18,815,837 |

.

This article was amended on Saturday October 18 2008. We gave the wrong figure for sales of artist Gerhard Richter's work. His auction sales turnover in 2007 was £49,586,782, not £49,429 as we originally said in the panel above.

- If you wish to complain about this article go here: I'm outraged!

- If you wish to compliment Lee Vidor on this article go here: I'm inraged!

- If you wish to go back to Serious Fun to find another lovely article go here: Yes Lee, take me back to Serious Fun to read another article, I feel smarter already.

If you wrote the article then well done and thank you. It's a great article.

If you wish me to remove it from this site then just ask me. I can do it if you don't want people to read it.